Green bonds have emerged as a critical instrument for financing the transition to sustainable architecture in Europe. These specialized debt instruments direct capital towards environmentally-friendly building projects, renewable energy integration, energy efficiency upgrades, and other low-carbon initiatives. Paralleling the growth of green bonds, carbon markets offer another avenue for sustainable architecture financing, providing a framework for monetizing emissions reductions through the trading of carbon offsets.

As European nations work to meet ambitious net-zero emissions targets, unlocking these innovative financing solutions will be crucial. Sustainable architecture – encompassing energy-efficient design, renewable energy, and eco-friendly materials – is a key pillar of the continent’s decarbonization efforts. However, the upfront costs of implementing sustainable practices can pose a significant barrier, especially for smaller-scale projects. Green bonds and carbon markets help overcome this challenge by mobilizing private capital and providing economic incentives.

Principles of Green Bonds

Green bonds are fixed-income securities where the proceeds are earmarked exclusively for eligible green projects. Adhering to the Green Bond Principles established by the International Capital Market Association, green bond issuers must demonstrate transparency in project selection, management of proceeds, and impact reporting. This framework helps assure investors that their capital is being directed towards legitimate environmental initiatives.

The green bond market has seen remarkable growth in recent years, with global issuance surpassing $1 trillion in 2020. Europe is a leader in this space, responsible for over 40% of worldwide green bond volumes. Prominent examples include the European Investment Bank’s climate awareness bonds and the European Green Bond Standard proposed by the European Commission.

For sustainable architecture projects, green bonds provide a reliable source of long-term financing. Funds raised can be used to upgrade building systems, install renewable energy, or construct new energy-efficient structures. By tapping into the growing pool of environmentally-conscious investors, green bonds help overcome the higher upfront costs associated with sustainable design and technologies.

Characteristics of Carbon Markets

Complementing the rise of green bonds, carbon markets offer another innovative financing channel for the sustainable architecture sector. These markets enable the trading of carbon credits, each representing the removal or avoidance of one ton of carbon dioxide equivalent (CO2e) emissions.

Sustainable architecture projects that reduce greenhouse gas emissions can generate carbon offsets, which can then be sold to polluters or investors seeking to offset their own carbon footprint. This creates an additional revenue stream to improve the financial viability of sustainable buildings, renewable energy installations, and other low-carbon initiatives.

The global carbon market was valued at over $2 billion in 2022, with Europe accounting for a significant share. Jurisdictions like the EU Emissions Trading System (EU ETS) and the UK Emissions Trading Scheme provide regulatory frameworks for carbon trading, setting emissions caps and facilitating the exchange of credits.

Strategies for Accessing Green Financing

To unlock the full potential of green bonds and carbon markets, European policymakers, financial institutions, and sustainable architecture stakeholders must collaborate on several key strategies:

Harmonize Taxonomies and Disclosure Standards: Establishing common taxonomies to define eligible green projects and standardized disclosure requirements will enhance transparency, comparability, and investor confidence. Initiatives like the EU Taxonomy for Sustainable Activities provide a valuable blueprint.

Expand Incentive Mechanisms: Governments can further stimulate green financing by deploying policy tools such as tax credits, preferential loan terms, and risk-sharing schemes. These incentives help bridge the cost gap between sustainable and conventional architecture.

Aggregate Small-Scale Projects: Green securitization techniques can bundle smaller sustainable architecture initiatives into investment-grade securities, providing access to capital markets. This approach overcomes the challenges faced by individual small-scale projects.

Leverage Public-Private Partnerships: Collaborations between the public and private sectors can combine the strengths of each to mobilize financing, share risks, and scale up sustainable architecture projects. Blended finance models integrate grants, concessional loans, and private capital.

Foster Carbon Offset Integrity: Robust accounting frameworks, transparent registries, and independent verification are crucial to ensuring the environmental integrity of carbon offsets generated by sustainable architecture initiatives. This builds trust in carbon markets.

Opportunities in Sustainable Architecture

The shift towards sustainable architecture in Europe presents numerous opportunities for innovation and investment. Key areas of focus include:

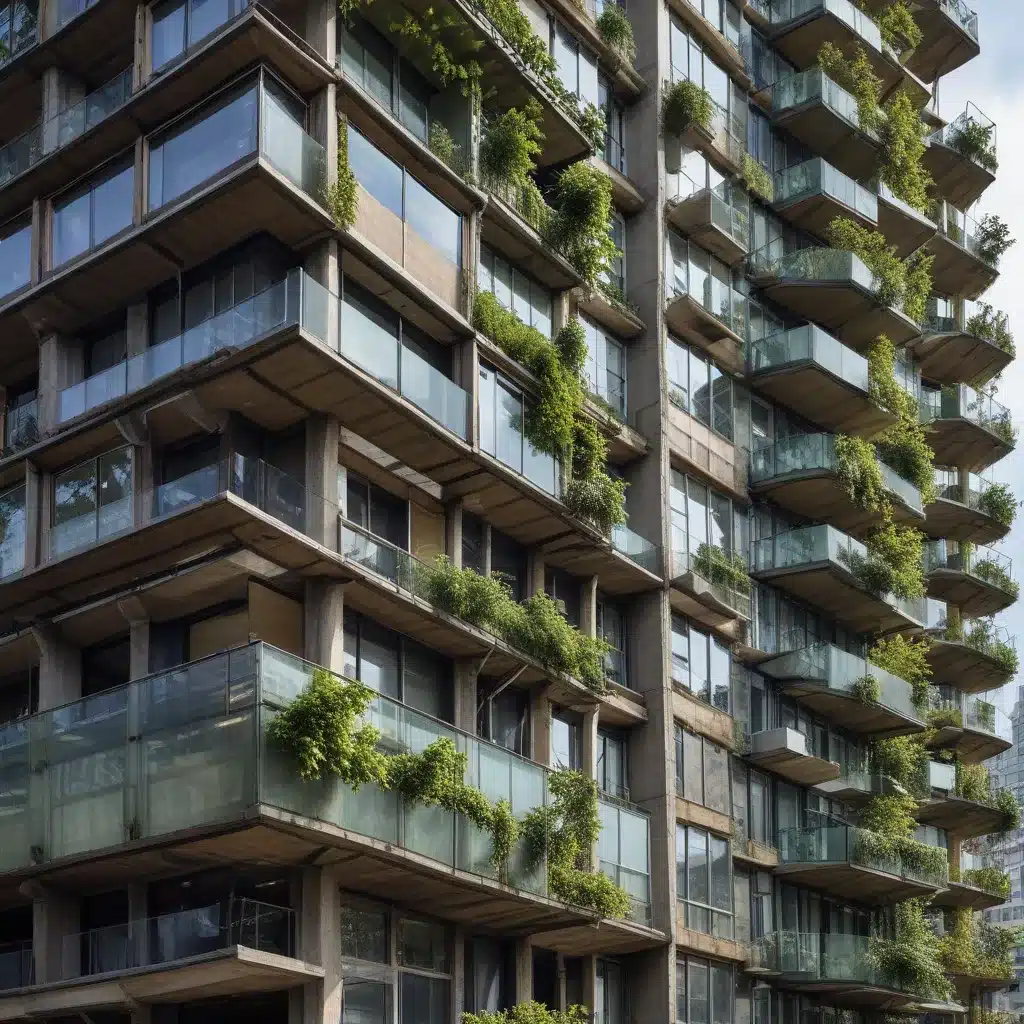

Renewable Energy Integration: Incorporating on-site solar, wind, or geothermal energy systems can transform buildings into self-sustaining, low-carbon assets. Power Purchase Agreements and virtual power purchase agreements enable renewable energy procurement even for urban projects with limited roof space.

Energy-Efficient Building Design: Passive design strategies, high-performance insulation, smart building technologies, and efficient HVAC systems can dramatically reduce the operational energy demands of buildings. Certifications like BREEAM and LEED provide validated frameworks for sustainable design.

Sustainable Material Selection: The use of recycled, bio-based, or carbon-sequestering materials in construction can significantly lower the embodied carbon footprint of buildings. Innovations in cross-laminated timber, hempcrete, and low-emission concrete offer promising alternatives to traditional building materials.

Challenges in Sustainable Architecture

Despite the growth of green financing and the sustainability momentum, the widespread adoption of sustainable architecture in Europe faces several challenges:

Financial Barriers: The higher upfront costs of sustainable design and technologies can deter investors and developers, especially for smaller projects. Accessing green bonds and carbon markets requires navigating complex financial structures and eligibility criteria.

Policy and Regulatory Hurdles: Inconsistent or insufficient policy frameworks, fragmented regulations, and a lack of enforcement mechanisms can hinder the mainstreaming of sustainable architecture practices across jurisdictions.

Stakeholder Engagement: Overcoming the inertia of traditional building practices, raising consumer awareness, and aligning the interests of developers, architects, financiers, and policymakers remain critical challenges in driving the sustainable architecture transition.

Innovations in Sustainable Financing

To address these challenges, the sustainable architecture sector is pioneering innovative financing models that leverage the strengths of both public and private sources:

Hybrid Financing Models: Blending green bonds, carbon credits, subsidies, and other incentives can create tailored financing solutions for sustainable architecture projects. This approach helps manage risks and optimize returns for investors.

Crowdfunding and Community Investment: Online crowdfunding platforms and community-based investment schemes are empowering citizens to directly support sustainable building initiatives in their local areas.

Performance-Based Incentives: Tying financial rewards to the actual environmental performance of buildings, as measured by energy savings or emissions reductions, can incentivize developers to maximize the sustainability outcomes of their projects.

By unlocking the power of green bonds, carbon markets, and innovative financing models, Europe is poised to accelerate the transition towards a more sustainable built environment. As the continent strives to meet its ambitious climate goals, sustainable architecture will play a pivotal role in driving the green transition. Through collaborative efforts and continued policy support, the sustainable architecture sector can unlock the investments needed to transform Europe’s cities and communities.